richmond property tax rate 2021

Due Dates and Penalties for Property Tax. Yearly median tax in Richmond City.

Richmond Property Tax 2021 Calculator Rates Wowa Ca

The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead.

. Property taxes are billed in October of each year but they do not become delinquent until Feb. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp. 2 1000 of assmt value between 3M to 4M 0002 Tier 2.

The tax year is July 1st through June 30th. Ultimate New Richmond Real Property Tax Guide for 2021. 802 Lemon Twist Ln is a 5 Beds 4 Full Bath s property in Richmond TX 77406.

105 of home value. Real estate taxes are due on January 14th and June 14th each year. Residential Property Tax Rate for Richmond Hill from 2018 to 2021.

Real Estate Tax Frequently Asked Questions FAQs What is the due date of real estate taxes in the City of Richmond. Over 4M 4 1000 of assessment value over 4M 0004 City of Richmond 2021 TAX RATES. Town of Richmond 5 Richmond Townhouse Road Wyoming RI 02898 Ph.

Taxes are payable on November 10th 1st half and May 10th 2nd half. The residential tax bill is divided as follows. Manage Your Tax Account.

Mailing Contact Information. Tax Rate 2062 - 100 assessment. 2022 Tax Rates.

Toronto Property Tax 2021 Calculator Rates Wowa Ca. Residential Property Tax Rate for Richmond from 2018 to 2021. Province of BCs Tax Deferment.

Richmond Hill - 27 per cent of. Richmond Hill accounts for only about a quarter of your tax bill. For information and inquiries regarding amounts levied by other taxing authorities please contact them directly at.

Tax bills are mailed out on July 1st and December 1st and are due on September. With our resource you will learn useful information about New. The November payment is for July 1st through December 31st and the.

Paying Your Property Taxes. Twenty-six counties had a revaluation in 2019 and 12. View photos map tax nearby homes for sale home values school info.

How are residential property taxes divided. Real Property residential and commercial and Personal Property. Understanding Your Tax Bill.

1317 Eugene Heimann Circle. Year Municipal Rate Educational Rate Final Tax Rate. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as.

Year Municipal Rate Educational Rate Final Tax Rate. 1 of the next year. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800.

Car Tax Credit -PPTR. The tax rate for FY 2021-2022 is 380000 cents per 100 assessed value. 102 rows Fifteen counties had a tax rate change in 2020-21 with four counties increasing and eleven counties decreasing their rate.

When contacting City of Richmond about your property taxes make sure that you are contacting the correct office.

City Of Richmond Adopts 2022 Budget And Tax Rate

Millage Rates Richmond County Tax Commissioners Ga

Ontario Property Tax Rates Lowest And Highest Cities

Toronto Property Taxes Explained Canadian Real Estate Wealth

About Your Tax Bill City Of Richmond Hill

Property Tax North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Richmond Hill Property Tax 2021 Calculator Rates Wowa Ca

Using His Luxury Horse Farm To Dodge Property Taxes Glenn Youngkin Is Sounding More And More Like His Idol Donald Trump Every Day Blue Virginia

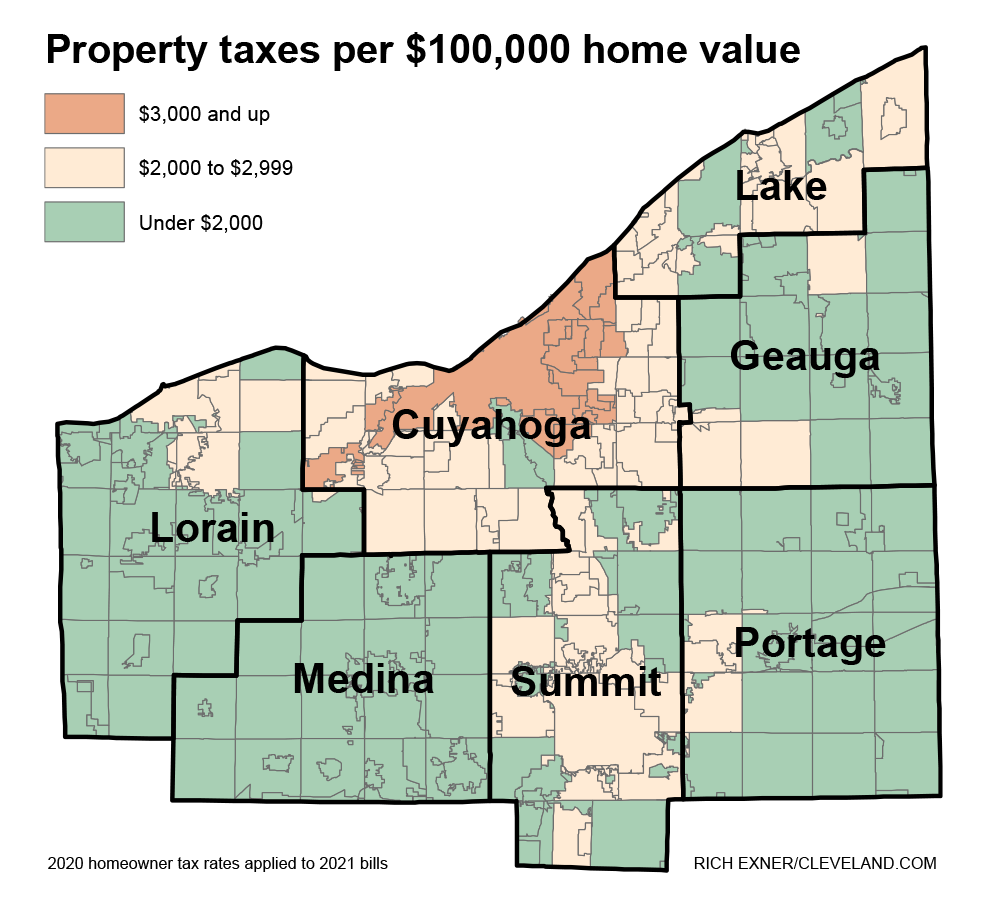

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Vermont Property Tax Rates Nancy Jenkins Real Estate

About Your Tax Bill City Of Richmond Hill

Finance Taxes Augusta Economic Development Authority

What Is The Property Tax Rate In Richmond Tx Cubetoronto Com

Lower Mainland 2022 Property Assessments In The Mail

Toronto Property Taxes Explained Canadian Real Estate Wealth

Richmond Ky Taxes Incentives Richmond Industrial Development Corporation

About Your Tax Bill City Of Richmond Hill